Carbon FAQs

What to consider when choosing a carbon program

Carbon projects are now accessible to small landowners in Vermont and neighboring states. As more options become available, it is important for both landowners and their foresters to explore the array of opportunities, including commitment, pricing, and quality associated with each project and developer. Additionally, compatibility with Vermont’s Use Value Appraisal Program needs to be confirmed before entering into a carbon project. While carbon payments provide economic incentives for landowners that assist with maintaining healthy and productive forests, the programs and payments also have numerous complexities and encumbrances.

These questions address some of the details of enrollment and participation in small landowner carbon projects, but interested landowners need to do thorough research to determine if a program is the right fit.

Click here for a downloadable PDF of the questions that you can use when talking with a developer.

1. What are some of the prescriptions likely allowed or considered in carbon programs?

In the compliance market, enrolled properties are required to do one of the following:

- Have an “approved” forest management plan such as FSC, SFI, Tree Farm, or State-approved such as a tax program plan

- Follow uneven-aged management prescriptions

- Maintain 40% canopy cover across 20 contiguous acres

Forestry practices that promote carbon storage enhancement over the long term are optimal, such as single-tree-selections and variable density thinnings, gaps, expanding gap/continuous cover irregular shelterwoods. Thinning from below, sanitation, and pre-commercial thinnings also are compatible but can be difficult to achieve depending on the property and market conditions.

2. What are the smallest parcels allowed?

This varies from one developer to the next and between compliance and voluntary market. NCX will accept parcels of any size. Forest Carbon Works’ minimum is 40 acres. Afforestation carbon companies like Greenline will also accept parcels of all sizes (see the Carbon Comparison table for more details).

3. Can some land in a parcel be excluded?

This depends on the developer and the market (compliance or voluntary). There is a spectrum here – some developers require all land under the same ownership to be included to avoid leakage (FCW and NCX) and also to accommodate baseline modeling. Others leave it up to landowners to determine which land they would like to enroll in (CORE).

4. What forestry activities are not allowed?

Carbon stocks must be maintained under Improved Forest Management guidelines so any activities that result in a decline in carbon stocks are not allowed. Typically, activities that result in what is called a “reversal,” reducing stocks below what has been credited, are not allowed; however, Forest Carbon Works is currently developing a harvest offset fee option that will allow for more flexibility and options.

5. What is the typical duration of participation?

1 year (NCX Harvest Deferral) to 10-40 years (CORE and TNC AFF) to 125 years (FCW)

6. Are contracts with the landowner required?

Yes. According to current knowledge from the carbon registries (ACR and Verra), once landowners contract with a company, then landowners are no longer eligible to contract with another company in the future, even if they contract for only a 1-year program. This is because 1 carbon credit is equal to 1 ton of carbon stored for 100 years. Even the 1-year deferral programs have to account for 100 years of storage for each credit issued. At this point, the carbon registries and verification bodies are viewing participating in multiple programs as double dipping and, therefore, will not allow it.

7. Are there fees to be paid to participate?

Mostly no for the small landowner-focused programs. Through new technologies and streamlined approaches, the developers have found ways to either cover the fees or reduce costs so landowners with less acreage can do projects.

8. Are there ways to exit these contracts if there’s a compelling emergency or an “act of God”-type of occurrence?

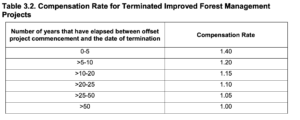

Landowners can buy back the number of offsets they have sold for their project if they would like to terminate. This would be at whatever the current market price is for carbon multiplied by a penalty rate that decreases as a landowner goes farther into a project. There also is a buffer (or insurance) pool that all projects contribute to that protects against disturbance, pest outbreaks, disease, etc.

9. Does landowners need to hire a lawyer? Hire a forester? Involve a forester?

Again, this varies with programs. Some landowners have chosen to hire a lawyer to assist with signing contracts, and some have not. Forest management plans are required for most programs – depending on the program, this service may be provided, and landowners should be aware of this requirement and their responsibilities (such as if they don’t have a forest management plan entering into a program, are required to have one, and the program will not provide cost assistance for this).

10. How are payments approved and structured?

Payments are either distributed annually or at the start of the contract. This depends on the carbon program.

11. Are payments taxable (Fed and VT)?

Generally, the sale of carbon credits will be treated as ordinary income, and there is not currently a federal tax program or incentive that treats this income differently. However, landowners should always consult with a tax professional to discuss their personal situation. Additionally note that tax laws change frequently, and there is considerable attention to the Carbon and conservation markets today. The future may bring a different answer here.

12. Will the state (FPR) develop/maintain a listing of available programs and weigh in on their effectiveness/appropriateness/ legality ESPECIALLY for those properties in the state UVA program?

Great question.

13. Are there requirements for landowners to be physically involved, or is any work typically contracted? Does this depend on the size of the property?

As of now, no. Some programs (TNC, American Family Forests) provide payment for practice, which can be used to hire contractors, or landowners may be able to do the work themselves after checking with the Forester and reviewing the contract.

14. Is the landowner or landowner’s forester always included/involved, or are forestry decisions removed from the landowner’s control?

Ideally yes – with the FCW program definitely. Landowners and foresters are included throughout all parts of the process – this may vary depending on the program.

15. What are typical penalties for landowners who doesn’t follow the rules?

If a reversal is triggered (landowners cut below what has been credited, on purpose), they will be penalized and have to pay back the credits they removed (at the current market price). Again, this will vary depending on the program. FCW’s program has ongoing verifications to monitor for reversals and maintained stocking. This is also ensured via ongoing communication with landowners and their forester. There is no information yet about if the short-term remote-sensing-based programs like NCX and CORE are going to be doing on-site verifications/monitoring to protect against reversals.

16. Do landowners need to check with the carbon program manager for every action involving forestry on the property? Like a personal firewood harvesting?

Commercial harvests do need to be coordinated with program managers/foresters. Small amounts of removals, such as regular firewood harvesting, that do not significantly impact the project can simply be documented in an annual reporting form (similar to FMARs), which are online and user friendly. For harvest deferral programs (NCX and CORE) there would not be a need to coordinate harvests as these are built around delaying harvests.

17. Is there a clear quantification of what wood may be removed once entered in the program?

Again, this depends on the program and is still under review. Some programs simply will not allow for harvest for 1/10/20 years except for a few cords of firewood.

18. Can open land be included?

Open land is excluded – the minimum acreage requirements refer to forested lands.

19. Can trees be planted along with an allowed harvest, or is that a “given” if there is a harvest?

Yes, as long as they are native species.

20. Is tree planting a requirement if open land is included?

Open land is excluded so tree planting is not required. There are afforestation carbon program options for converting non-forested land to forested – these are gaining traction.

21. Are early successional acreages preferred as land in a program?

Not in improved forest management – some early successional mixed with more mature forest can work, but often there is not enough additionality compared to baselines with early successional forested areas.

22. Are typical TSI activities allowed (thinning and crop tree release)?

Yes and encouraged – these treatments are both great for carbon enhancement and storage.

Activities that promote mature, late-successional forest structure are ideal – heterogeneous structure and diversity, balance of ages, etc.

23. Who pays for the set-up and sale of a carbon project?

Typically developers, but details on this are critical to decision-making. With a new focus on small landowners, developers are covering all costs associated with carbon projects (inventory, analyses, verification, etc.). Investments, new technologies, and methodologies have made it possible for developers to take this approach, regardless of property size.

24. What are the costs of various programs, and how do those costs impact net revenue from the sale of credits?

Variation in revenue from the sale of credits depends on the following: on-the-ground inventories and verification; credit pricing; and in-house development costs (modeling, etc.). Compliance credits pay more than three times voluntary credits, but these projects require more oversight than voluntary projects. Some developers in the voluntary market also utilize reverse-auction credits to fund their projects.

25. What is leakage?

Leakage is the result of harvest activities increasing in an area outside the carbon project as a result of the project, resulting in increased emissions.

26. How is leakage determined?

Leakage is determined by a percentage deduction of credits or “leakage factor” (percentage varies). This is applied to the difference in harvest volume relative to the baseline.

27. What is the FIA baseline?

The FIA (Forest Inventory and Analysis) baseline is determined utilizing data from the FIA permanent plot system in place across the entire US. This is re-inventoried on a 5- to 10-year basis to determine regionally-specific basal areas and above-ground biomass amounts. These are broken down by forest type and site productivity, into what are called Supersections. These form project “baselines,” which each project is compared to along with “Common Practice Values” to both determine project viability and additionality.

28. What happens when the contract with a carbon project developer ends but the carbon program is contracted for 30 to 90 more years?

If this were to happen, landowners are responsible for the continuation of the project and any associated responsibilities (reporting, inventories, verifications).

29. When and how do landowners cover the costs of inventory, verification audits, and reporting?

The small landowner-focused programs do not require the landowner to cover any of these costs. Again, landowners should double-check their contract and ask their developer.

30. Can properties with no-cut easements be entered in carbon projects?

If a property has a no-cut or highly restrictive harvest easement that encompasses the majority of the property, then this will not make it eligible for a carbon project because the project cannot prove additionality with the easement in place before the commencement of the project. If an easement is put in place in conjunction with the project that incorporates the project, then it can have a no-cut/harvest restriction. This will reduce risk associated with the project and, therefore, the percentage of credits contributed to the buffer pool.

31. How do landowner aggregation projects work?

The voluntary market allows for aggregation of smaller parcels to create one larger “project.” This is the approach that both NCX and CORE are taking and why they have enrollment periods. All acreages and, therefore, credits quantified from parcels (regardless of size) within an enrollment period are equal to one “project.” Both methodologies are new, remote-sensing based, and have not yet been verified. Compliance projects do not allow aggregation so the credits issued for each landowner’s acreage belong to that landowner/property until they are sold. The Cold Hollow carbon project is an example of a local, landowner aggregate project that aggregated approximately 8000 acres across 12 landowners to make a feasible project that would offset development costs and still be able to pay the landowners (with no fees for the landowners).

32. Can you subdivide a carbon project?

Properties with a carbon project on them can be subdivided, but the project stays with the property. For example, if you have 100 acres that is a project and subdivide it into 50 acres, both of the 50 acre parcels will still be part of the original 100-acre project.

33. What is the amount of the risk pool for various types of projects?

Compliance projects contribute 17-19% of credits issued to a buffer account to protect against unintentional reversals. The quantity of the contribution is determined by a project’s reversal risk rating based on the potential for reversals associated with different types of risks and project-specific circumstances. These risk types are financial (bankruptcy), management (illegal harvesting, over-harvesting, conversion to non-forest), social (government policies and regulations), and natural disturbance (wind, fire, disease/insects).

34. What are the fees charged by carbon developers?

This would include projects where the developer covers costs out of the sale of carbon. In essence paying a net rate from the shall of the credits. These vary and, depending on the developer, may or may not be transparent. Costs include: credit registration (Listing Fee, Annual Account Fees), credit sales (brokerage fees), project development (inventory, documentation, modeling, carbon accounting, management fees); third-party audit (verification). Depending on the project size, number of credits issued, and credit pricing, landowners will net between 30 to 50% of the profit from credit sales (at least with FCW projects). Typically this amount increases over time as the majority of the development costs are taken care of at project initiation.

VT FPR Private Lands Advisory Committee

November 11, 2021